Top stories

LifestyleWhen to stop Googling and call the vet: Expert advice on pet allergies from dotsure.co.za

dotsure.co.za 3 days

AutomotiveHilux Custom Builds offers purpose-built solutions for your business

Toyota South Africa Motors 3 days

YouFarm provides farmers with access to collateral-free funding and technology by getting people to invest in crops and livestock and share the profits with the farmers when the produce goes to market.

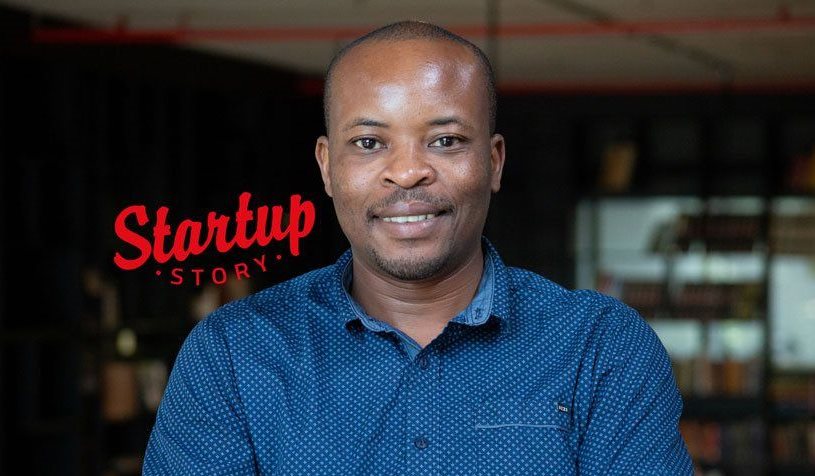

We chat to John-Paul Matenga, CEO of YouFarm, to find out more about growing a community of virtual farmers that uses the power of crowdfunding to earn money and support Zimbabwean farmers.

YouFarm provides farmers with access to collateral-free finance by getting people to invest in crops and livestock and share the profits with the farmers when the produce goes to market.

Towards the end of 2016, my mother acquired a farm. She then asked me to make the land productive. I had no farming experience and no collateral so there was no way that a bank was going to lend me money. I then realised that there were thousands of farmers in the same boat.

At around about the same time, I was looking at ways of investing small amounts of money. It then occurred to me that I could get farmers funded by getting people to invest in crops and livestock and share the profits when the produce goes to market.

We provide agricultural finance for farmers, access to markets for the produce and agronomists to maximise yields. For the crop investors, we provide a safe insured and profitable investment option. We curate all the farms and farmers.

We have been self-funded from day one meaning that we have not been able to work with all 180 of our registered farmers. We now need investment to help us scale! Operating in Zimbabwe is very difficult as you can not plan or budget but we have made it work. We are launching in South Africa so we hope we can avoid some of the mistakes we made in Zim.

Just get started! Don’t wait for your idea or product to be perfect. Get going!

Our proudest achievement so far has been to take a 23-year-old farmer who had $0 all the way to harvest in a space of four months and the investors got decent returns on the crop as well.

The future looks amazing for African entrepreneurs! I was recently in Tunisia for the Afric’up Summit and I met entrepreneurs working on real problems that will impact peoples lives. The future is bright!

The amount of things that we have learned in such a short space of time and the connections and links to potential partners is amazing. We have always wanted to scale into SADC and Startupbootcamp AfriTech has helped us get to our goal faster!

I have the pleasure of attending meetings and summits across Africa and one thing that is always lacking is the entrepreneurs' perspective. You hear investors speak, government officials speak, organisers speak, but you will never get a panel where the entrepreneurs speak about their challenges or needs from the policymakers. This is what I would love to see changed.

Perseverance, a thick skin and the ability to learn from failure.

A major highlight has been getting into SBC AfriTech. My biggest struggle as an entrepreneur is not taking time off to rest. I end up suffering from burnout.

Entrepreneurship is not for everyone, so rather than encourage people I’d rather tell them the truth, it's not easy and there is no such thing as an overnight success.

In the next five years we plan to be in Mozambique, South Africa, Zimbabwe, Zambia, Botswana, Tanzania and Namibia. Our goal is to change the way agricultural finance is done in Africa.