As consumers continue to feel the pressure, with rising interest rate hikes coupled with skyrocketing food costs, loyalty programmes are helping consumers, not only by offering cash back on purchases, but in changing behaviour by switching their customers to often cheaper house brands.

“Customers don’t mind jumping through a few hoops if there is a real chance that they can receive a meaningful benefit, especially if in these trying times it helps avoid dipping more into credit. All that is required is to deliver on a compelling proposition that encourages shoppers to step into your store first, before visiting your competitors,” says Steve Burnstone, CEO at Eighty20.

The Eighty20 XDS Credit Stress Report outlines how the double impact of rampant inflation and the 4.25 percentage point increase in the prime lending rate over the past 18 months have eaten into disposable income.

The top six most used loyalty programmes in South Africa are either grocery or health and beauty retailers.

According to the 2022 Truth & BrandMapp Loyalty Whitepaper, loyalty memberships are also growing with the average number of active memberships per customer increasing to just over nine.

BrandMapp’s research shows that the top benefit enjoyed by loyalty members is redeeming for cash. Furthermore, 84% of customers say loyalty programmes influence where they shop, while 56% say it influences the products they purchase.

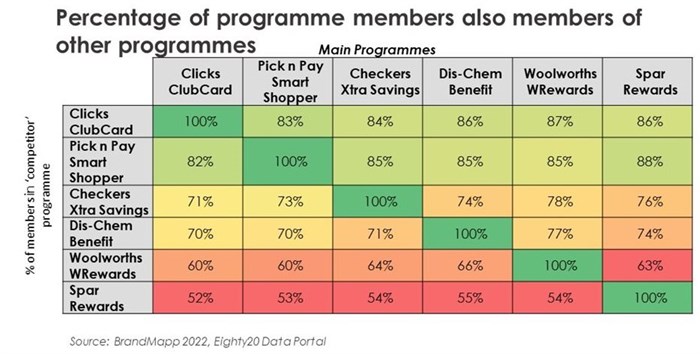

Given the proliferation of programmes, it is not surprising that there is a significant level of customer overlap across retailers.

The BrandMapp research represents the top-earning 30% of the country, (12.8 million adults), living in households that earn more than R10,000 per month. Using this study, it is interesting to see how the country’s top loyalty programmes appear to all share the majority of economically active consumers.

Clicks ClubCard, the largest programme in SA, shares 70% of its members with Dis-Chem, its primary competitor, while 86% of DisChem members are also Clicks ClubCard members.

While 73% of Pick n Pay Smart Shoppers also have a Checkers Xtra Savings card, 85% of Checkers loyalty members are also Smart Shoppers.

With the exception of Woolworths and Spar, all of the top 6 programmes share more than 70% of their members with each of the other programmes

High levels of cross-membership are relatively unchanged by income segment - it would seem that saving money or buying on discount is appealing, irrespective of one’s affluence. Although customers may have preferred retailers, it is clear that customers tend to shop at most of the main retailers.

“Customers generally are not as loyal to a particular retail brand as retailers would like to believe. In fact, customers are typically more loyal to a brand of tomato sauce than the store they bought it from,” says Burnstone.

For example the Constantia Village in the southern suburbs of Cape Town has a Woolworths and a Pick n Pay no more than 50m apart. Over the last three months, 38% of shoppers visiting the Pick n Pay also visited the Woolworths and 52% vice versa. In fact, almost a quarter of all shopping trips to Constantia Village involve customers visiting both stores.